us japan tax treaty social security

The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan. Protocol PDF - 2003.

The Us Uk Tax Treaty Explained H R Block

1 JANUARY 1973.

. You would list the foreign SS benefits on line 16a and 16b. Subject to the provisions of paragraph 2 of Article 18. The Japanese-US tax treaty provides that SS benefits by either country are only taxed by the country of residence.

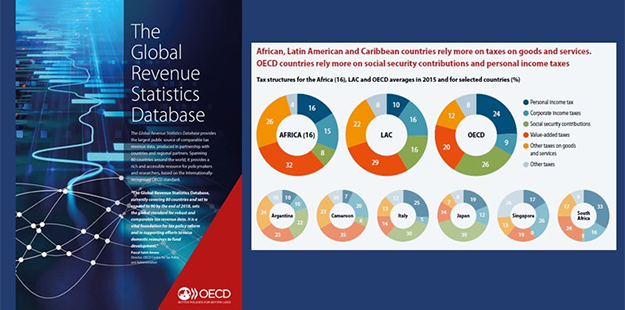

When it comes to the United States and the international tax treaties one of the main purposes behind the tax treaty is to help. Japanese Pension Income Under USJapan Taxation Treaty. If you are self-employed you are to pay social security to the country in which you spend.

3 Pensions and other income Most pension distributions. UNITED STATES-JAPAN INCOME TAX CONVENTION GENERAL EFFECTIVE DATE UNDER ARTICLE 28. The United States and Japan entered into a bilateral international income tax treaty several years ago.

The Japanese-US tax treaty provides that SS benefits by either country are only taxed by the country of residence. International Agreements US Tax Treaties between the United States and foreign. Protocol Amending the Convention between the Government of the United States of America and the Government of Japan for the Avoidance of Double Taxation and the.

The US-Japan Social Security Agreement which went into effect October 1 2005 improves Social Security protection for people who work or have worked in both countries. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens and. And Social Security Payments Article 24----.

Up to 85 of US Social Security payments may be considered taxable income in both the US as well as in Japan. If you are on a temporary assignment in Japan you will be required to pay Social Security to the US. Technical Explanation PDF - 2003.

Income Tax Treaty PDF - 2003. On a yearly basis 70 of your pension plan distributions are taxable 7000 taxable amount divided by 10000 gross amount So. Article 71 of the United States- Japan Income Tax Treaty states that profits are taxable only in the Contracting State where the enterprise is situated unless the enterprise carries on.

An agreement effective October 1 2005 between the United States and Japan improves Social Security protection for people who work or have worked in both countries. March 23 2020 347 PM.

The Complete J1 Student Guide To Tax In The Us

Japan Taxation Of International Executives Kpmg Global

Us Expat Taxes For Americans Living In Japan Bright Tax

Can Higher Inflation Help Offset The Effects Of Larger Government Debt Penn Wharton Budget Model

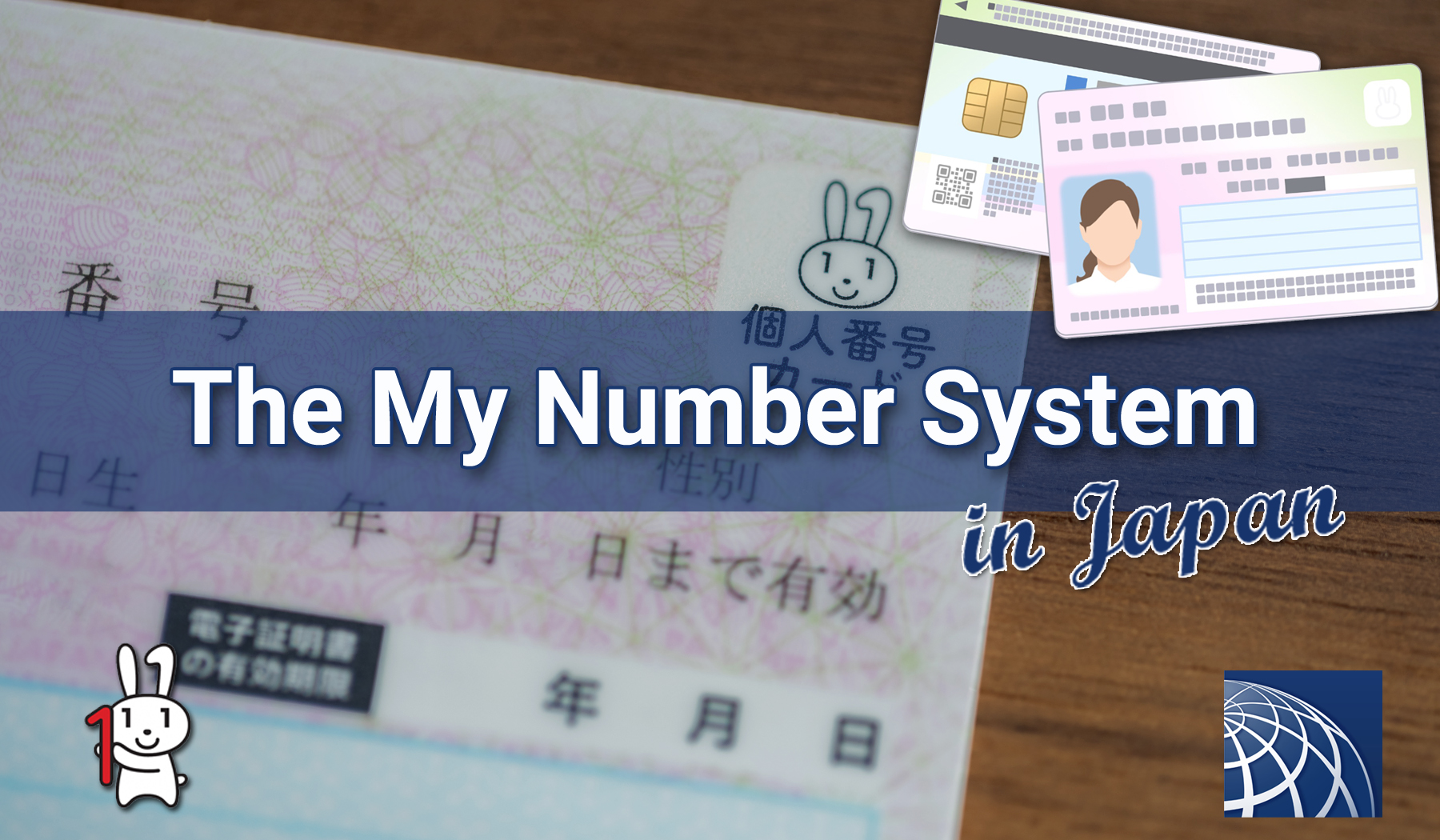

The My Number System In Japan And How It Affects Non Japanese Plaza Homes

Doing Business In The United States Federal Tax Issues Pwc

Spanish Taxes For Us Expats Htj Tax

Us Expat Taxes For Americans Living In Japan Bright Tax

How Japan Can Boost Growth Through Tax Reform Not Stimulus Tax Foundation

U S Japan Social Security Totalization Treaty You Must Enroll In Japanese Health And Pension Hoofin

Japan United States International Income Tax Treaty Explained

Should The United States Terminate Its Tax Treaty With Russia

12 Top Expat Tax Tips Services For Living In Saudi Arabia

The Complete J1 Student Guide To Tax In The Us

Self Employment Tax For U S Citizens Abroad

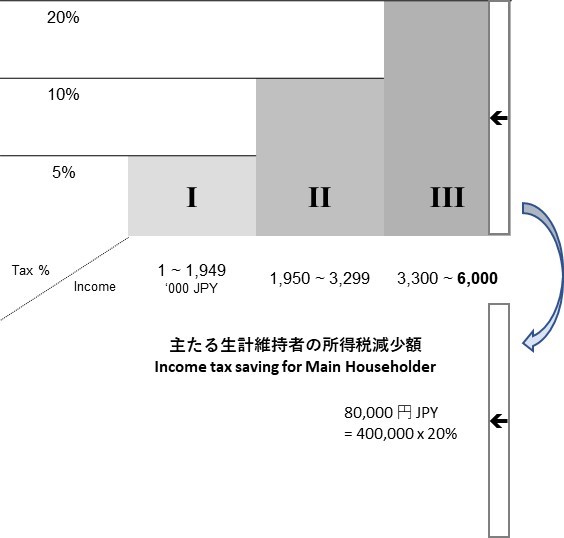

Social Security Tax Deduction For Social Insurance Premium Of Spouse Anshin Immigration Social Security